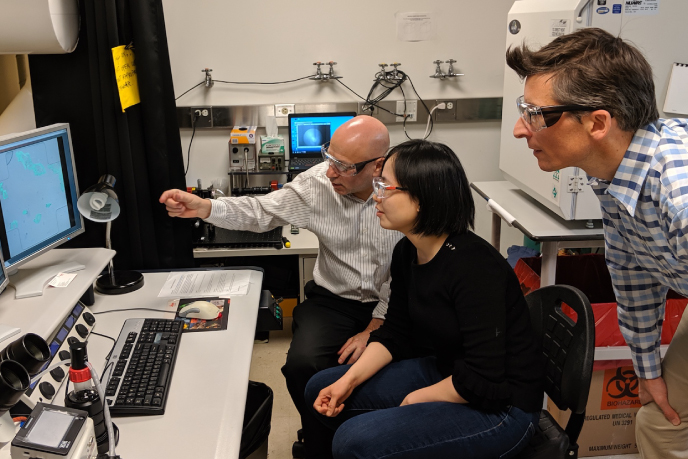

Principal Investigators

At a Glance

In Princeton’s Net-Zero America study (Larson et al., 2021) electrification is a central feature of all modeled decarbonization pathways for the U.S. However, perhaps surprisingly, low-carbon fuels, including hydrogen (H2) and Fischer-Tropsch liquids (FTL), still account for 40-55% of final energy use in 2050, when the goal of economy-wide net-zero emissions is reached. To help understand the prospective competitiveness of different clean fuels, Jenkins and Larson, together with researchers Fangwei Cheng and Hongxi Luo, carried out detailed lifecycle carbon and cost assessments of multiple technology pathways for producing clean fuels from natural gas, sustainable biomass or electricity (Cheng et al., 2023a). After passage of the 2022 U.S. Inflation Reduction Act (IRA), which provided unprecedented incentives for deploying low greenhouse gas-emitting fuels, the researchers extended the analysis to assess impacts of the IRA (Cheng et al., 2023b). The findings of the extended analysis can inform decision making regarding investments and further policies regarding clean fuels.

Research Highlight

The U.S. goal of net-zero greenhouse gas (GHG) emissions by 2050 has become a major policy driver, with the 2022 Inflation Reduction Act (IRA) providing unprecedented incentives for deploying low GHG emissions technologies. Incentives include Section 45V credits for clean H2 , 45Q credits for carbon capture and storage (CCS), 45Z credits for sustainable liquid fuels, 45Y credits for clean electricity generation and others. To better understand the prospective competitiveness of different clean fuels under the IRA, Larson and colleagues extended their recently published (Cheng et al., 2023a) lifecycle carbon and cost assessments of multiple pathways (P#) for fuels production. For technologies anticipated to be commercially deployable in the early 2030s, researchers examined the impacts of IRA provisions on costs of producing H2 and Fischer-Tropsch liquid fuels using natural gas, electricity, or net-carbon-neutral biomass as feedstocks (Cheng et al., 2023b) (Table 3.1).

Hydrogen and Fischer-Tropsch liquids production pathways.*

Hydrogen

With credits from 45Q, H2 produced by reforming natural gas with CCS (P2 or P3) is cost-competitive with conventional carbon-intensive H2 from natural gas without CCS (P1) (Figure 3.1a; P1-13 defined in Table 3.1). Also, because of its zero-carbon footprint, electrolytic H2 (P3) is eligible for the maximum available 45V credit and is consequently less costly than P2 or P3. Thus, the IRA incentives promise to encourage deployment of H2 production via P2, P3 and P4 pathways. H2 made by biomass gasification (P5) has a non-zero carbon footprint due to emissions from upstream biomass collection and transport, so the available 45V incentive is less than for P4. The P5 pathway is not cost-competitive with incumbent H2 (P1). The same is true for biomass gasification with CCS (P6), despite this pathway being able to garner the full 45V credit because negative emissions more than offset the upstream emissions. The P6 pathway could instead collect 45Q credits for its CCS, but the 45V credits are larger, and an individual facility may only collect one type of IRA credit.

Figure 3.1b demonstrates that the size of a pathway’s IRA incentive is not uniformly proportional to the emissions reduction it achieves. IRA incentives for the P2 and P3 pathways (about $75/tCO2 e reduced) are ostensibly designed to reward emissions reductions, because the underlying technologies are arguably commercially mature today. In contrast, P4 technologies are not yet mature and are projected to experience significant cost reductions with further technology development and deployment. The additional “bonus” IRA incentive for P4 ($143/tCO2 e reduced), therefore, appears aimed at promoting technology advancement and cost reduction.

Levelized cost of fuel (LCOF) and lifecycle GHG emissions for conventional (high carbon intensity) H2 and five clean H2 pathways. Negative values are co-product revenues or IRA credits. The IRA disallows any one facility from claiming more than one type of credit. For a pathway for which multiple credits may apply, the one that provides the highest benefit is taken.

Meanwhile, the biomass H2 pathways (P5 and P6) have little to no “bonus” IRA incentive (Figure 3.1b). The inherent asymmetry in the bonus incentive between P4 and P5/P6 may be explained in part by the more intrinsically modular nature of P4 technology. Modularity is among the most important features of energy technologies that have seen rapid cost reductions in the past as deployments have accelerated, such as wind turbines and solar PV panels (Malhotra and Schmidt, 2020). A sizeable IRA bonus incentive for P4, therefore, seems well aligned with the ambitious goal of rapid clean H2 expansion in support of rapid decarbonization of the economy. On the other hand, with a comparatively small bonus incentive for P6, the pathway with the highest carbon mitigation potential, the IRA misses an opportunity to boost a technology that might also contribute significantly to rapid decarbonization goals.

Fischer-Tropsch liquid fuels

The IRA liquid fuels incentive, 45Z, will be discontinued in 2027, so it will not be available in the 2030s timeframe of our analysis without an extension. Liquid fuel pathways might still derive some benefit from 45V and 45Q incentives, however, as reflected in pathways P7-P9 (Figure 3.2a). These pathways represent facilities synthesizing liquid fuels from inputs of H2 and CO2 . They incorporate 45V credits for H2 production (at separate facilities, P2 – P4) and 45Q credits for CO2 from separate direct air capture facilities. Pathways P10 and P11 synthesize fuels using H2 from P5 and P6, respectively, and carbon-neutral biogenic CO2 recovered from the P5 and P6 facilities. The liquids costs for P10 and P11 incorporate 45V credits associated with P5 and P6 facilities, which are assumed to be adjacent to, but separate from, the liquids production facility. CO2 removal is intrinsic to making H2 from biomass, and so it is assumed that the liquids producer incurs no extra cost for the CO2 , beyond what is reflected in the cost of the delivered H2 . As Figure 3.2a quantifies, the production cost for only one of the low-carbon liquid fuels pathways, P9, falls within the range of U.S. wholesale jet fuel prices observed over the past decade.

Figure 3.2a also shows results for P12 and P13 pathways, neither of which qualify for any credit under the IRA, because the current 45Z credit will end in 2027. These represent facilities that integrate biomass gasification with FischerTropsch synthesis to produce liquid fuels without and with CCS, respectively. Pilot and demonstration scale projects using technology configurations that resemble these are under development today (Mesfun, 2022). Note that pathways P10 and P11 also produce bio-derived fuels but are somewhat artificial configurations designed specifically to maximize the capture of IRA credits. The integrated P12 and P13 facilities have lower capital costs and higher energy conversion efficiencies than their counterpart two-facility configurations, P10 and P11, but they are unable to exploit IRA credits. On balance, P10 has slightly lower production costs than P12 because the embedded 45V credit for P10 offsets the lower capital and fuel costs for P12. The large 45V credit embedded in P11 more than compensates for the lower capital and biomass costs for P13.

Levelized cost of fuel (LCOF) and lifecycle GHG emissions for petroleum jet fuel and eight alternative clean liquid fuel pathways. The jet fuel range covers the 10-90th percentile range in wholesale jet fuel prices in the U.S. during 2012- 2022, when the median value was $2.2/gallon.

Levelized cost of fuel (LCOF) for clean fuel pathways as a function of assumed duration of 45Z credits. The gray shading represents the 10-90th percentile range in wholesale jet fuel prices in the U.S. during 2012-2022, when the median value was $2.2/gallon.

Renewal and extension of the IRA 45Z credit into the 2030s would impact the relative competitiveness of liquid fuel pathways. In the following analysis, it is important to note that the value of a 45Z credit increases with decreasing lifecycle emissions of a fuel pathway. Figure 3.2b shows fuel production costs for P7-P13 as a function of the duration over which a 45Z credit is assumed to be available. Not surprisingly, longer 45Z durations provide for lower production costs. However, pathways P7, P8, P10 and P12 remain uncompetitive with jet fuel prices regardless of the 45Z duration because the 45Z credit is relatively modest for these pathways, all of which have positive lifecycle emissions.

As noted earlier, the cost for the electrolysis-based pathway, P9, which has zero emissions, falls within the recent historical range in jet fuel prices, even without any 45Z credit. If the 45Z duration is at least two or five years, then fuel production costs for a second pathway (P11) and a third pathway (P13), respectively, also fall within the competitive range. The P11 pathway captures both 45V and 45Z credits, while P13 captures only a 45Z credit, which helps explain the lower cost for P11 than P13 at any given 45Z duration. Costs for both P11 and P13 fall rapidly with increasing durations of 45Z because their negative lifecycle emissions (Figure 3.2a) lead to high 45Z credit values. The P11 cost falls more rapidly than for P13 because the lower overall energy conversion efficiency of P11 means it sacrifices fuel production for additional byproduct CO2 capture. This results in more negative lifecycle emissions per unit of fuel produced and a larger 45Z credit than for P13.

One final observation concerns P11 and P13 pathways, both of which start with biomass and end with liquid fuel produced. In one situation, without considering 45Z credits (Figure 3.2a), the IRA credits that P11 garners leads it to have considerably lower production costs than P13, which does not receive any IRA incentive. In another situation, when 45Z credits are additionally considered (Figure 3.2b), the cost differential between P11 and P13 grows as the duration of the 45Z credit grows. Thus, in both situations, IRA credits are incentivizing a more capital-intensive and less-efficient (P11) over a more efficient (P13) approach to biofuel production. This is concerning because sustainable biomass energy feedstock is a limited resource.

Additional analysis reported elsewhere (Cheng et al., 2023b) evaluates the impact on clean-fuel production costs of garnering IRA credits along with credits available under California’s Low Carbon Fuel Standard and the federal Renewable Fuel Standard. This “stacking” of credits appears to be allowable under the IRA.

References

Cheng, F., H. Luo, J.D. Jenkins, and E.D. Larson, 2023a. The value of low- and negative-carbon fuels in the transition to net-zero emission economies: Lifecycle greenhouse gas emissions and cost assessments across multiple fuel types. Applied Energy 33:120388. (https://doi.org/10.1016/j. apenergy.2022.120388).

Cheng, F., H.Luo, J.D. Jenkins, J.D., and E.D. Larson, 2023b. Inflation Reduction Act impacts on the economics of clean hydrogen and liquid fuels. Submitted to Joule, April 2023.

Larson, E. et al., 2021. Net-Zero America: Potential pathways, infrastructure, and impacts final report, Princeton University. (https://doi.org/10.5281/zenodo.6378139).

Malhotra, A. and T.S. Schmidt, 2020. Accelerating low-carbon innovation. Joule 4(11):2259-2267. (https://doi.org/10.1016/j.joule.2020.09.004).

Mesfun, S.A., 2022. Biomass to liquids (BtL) via FischerTropsch – a brief review, European Tech. & Innovation Platform – Bioenergy. (https://www.etipbioenergy.eu/images/ ETIP_B_Factsheet_BtL_2021.pdf)