Principal Investigators

At a Glance

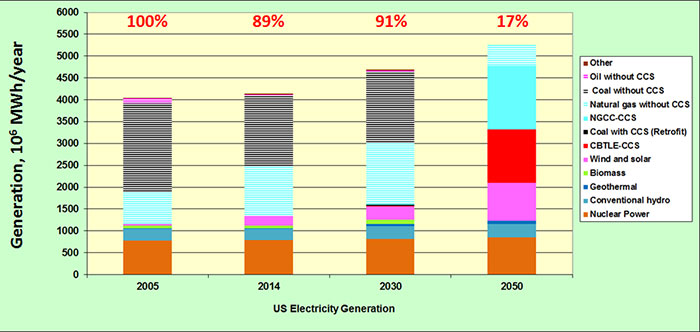

Meeting current targets for reducing greenhouse gas emissions to mitigate climate change will require major changes in the makeup of the US electricity sector in the coming decades. A study by the Energy Systems Analysis group identifies incentives for carbon capture and storage (CCS) as a promising and economically viable approach to meeting emissions reduction goals. The study includes a thought experiment that analyzes how the contributions of different CCS technologies, along with shifts to renewable energy sources, could enable the US to achieve an 83% reduction in greenhouse gas emissions from power generation by 2050.

Research Highlight

One ongoing activity launched in 2015 by the Energy Systems Analysis Group involves exploring strategies for getting the carbon capture part of the faltering global carbon capture and storage (CCS) enterprise back on track, and the potential role of CCS in a low-carbon future for US electricity.1 The CCS focus stems from the prospect that without CCS, achieving a low-carbon global energy future is likely to be much more costly and perhaps impossible,2 and the growing popular belief that CCS is too costly to become a major carbon-mitigation option.3

CCS progress has been slow partly because first-of-a-kind project costs have been higher than expected. Many projects were canceled because government incentives were inadequate to enable them to go forward. In the US, the shale gas revolution has stymied CCS market launch. But CCS costs are likely to be reduced through experience (learning by doing). Incentives are needed to realize cost reductions, and are economically justified4 if there are good prospects for cost reduction through technology cost buydown.

The proposed CCS initiative involves expanded federal research, development, and demonstration on advanced carbon dioxide (CO2) capture concepts, the phased introduction of a greenhouse gas emissions price sufficient to ensure that all fossil-fuel based power plants built after 2030 will have CCS, and—the centerpiece—a national Low Carbon Electricity Portfolio Standard (LCEPS). The initiative is a variant of the successful worldwide approach for advancing renewables via technologypush (support for research, development, and demonstration) and market-pull (feed-in tariffs, tax credits, and renewable portfolio standards). Cost reductions and growth have been especially dramatic recently for photovoltaic technology.5

The LCEPS would mandate low-carbon electricity as a growing fraction of electricity from 2021 to 2050. Wind, solar, hydro, nuclear, and CCS technology providers would compete to provide this lowcarbon electricity. The Standard would also offer technology cost buydown incentives for options offering good prospects for cost reductions via learning by doing.

Current nuclear technologies would not qualify for early technology cost buydown incentives because historically nuclear technologies have had negative learning rates,6 but advanced concepts with good prospects for cost-cutting (e.g., factory-manufactured modular reactors) might qualify later. For wind and solar, which have good prospects for continuing cost reduction,7 incentives might be continued as current tax credits. Incentives for promising CO2 capture options would be determined by a market mechanism such as a reverse auction.8

The extent to which CCS costs can be reduced via experience is not known, because there has been no significant CCS experience. However, commercial experience with related technologies suggests that cost reductions through experience are plausible, especially if government requires, as a condition for receiving subsidies, information-sharing on cost-reduction opportunities among successive projects. Moreover, the study shows that for the approach chosen for carrying out technology cost buydown, with captured CO2 sold for enhanced oil recovery, the US government can afford to find out, by supporting a few projects, the actual learning rates for promising CO2 capture technologies. This is because, if the technology cost buydown process takes place when crude oil prices are $75 per barrel or higher,9 the gross new federal corporate income tax revenues from subsidized projects (arising from new domestic production of liquid fuels displacing imported oil) would typically be greater than required subsidies—an outcome first recognized by the National Enhanced Oil Recovery Initiative.10

The study found that, of the five near-term CCS options considered, two offer good prospects for becoming competitive after 2030 as new power plants if earlier demonstration and technology cost buydown activities are successful: NGCC-CCS, a natural gas combined cycle; and CBTLE-CCS, a system coproducing synthetic liquid fuels and electricity (30% of output) from coal and biomass with enough biomass (34%) to realize zero net greenhouse gas emissions,11 based on earlier research.12

The study explored, via a thought experiment, whether these CCS technologies, plus wind and solar, might provide the basis for a plausible low-carbon future for US electricity. The thought experiment was constructed to realize an 83% reduction in greenhouse gas emissions for US power generation by 2050.13 Key assumptions include:

- Existing coal-generating capacity is retired from 2031 to 2050 at a constant rate of 13 GWe per year, leading to retirement of all coal plants by 2050.

- Concomitant CBTLE-CCS and NGCC-CCS deployment, such that coal input capacity remains constant at the 2030 level and enough NGCC-CCS capacity is deployed to match electricity generation at the rate for retired coal plants.

- The remaining power not met in 2050 by nuclear, hydro, or geothermal power is provided by a mix of NGCC and intermittent renewables (wind and solar), assuming that three-quarters of total NGCC power is in plants with CCS—which implies widespread adoption of CCS retrofits. The implicit deployment rates14 are sufficiently modest that they are plausibly feasible with the assumed policy incentives.

Under these assumptions, the US electricity generation mix in 2050 (see Figure 3.1) includes NGCC (37%), CBTLE-CCS (23%), wind and solar (16%), nuclear (16%), conventional hydro (6%), and geothermal power (2%)—a diversified electricity supply portfolio,15 for which 69% is baseload electricity—slightly less than the 72% average for baseload power from 1998 to 2014. Although the CBTLE-CCS power share in 2050 is less than coal’s 39% share in 2014, CBTLE-CCS also provides 5.2 million barrels per day of zero-emissions transportation fuels in 2050, so that coal use via CBTLE-CCS in 2050 is slightly more than coal use for power in 2005. Moreover, CBTLE-CCS is a promising way whereby reduced oil import dependence16 and carbon mitigation goals might be pursued simultaneously.

The 2.5 gigatons per year of CO2 storage rate for the US in 2050 implies the necessity of a partnership between the power industry and the oil and gas industries that would manage CO2 storage. The 625 million tons per year of biomass then required can plausibly be provided by agricultural and forest residues not currently being used17 and by growing biomass on abandoned cropland18 (thereby avoiding food/fuel conflicts). The biomass required is modest because: (a) CBTLE-CCS requires only about 40% as much biomass energy per gigajoule of liquid transportation fuel output as a conventional cellulosic biofuel such as cellulosic ethanol, and (b) attractive CBTLE-CCS economics based on costly marginal biomass supplies can be realized under a strong carbon mitigation policy.19

The proposed CO2 capture or similar public policy initiative is needed to facilitate realization of the envisioned or similar 2050 outcome, because historically major energy system transformations have required 80 to 130 years20—far longer than the time during which climate scientists say evolution to a low-emissions energy future must take place to keep major climate change damages to tolerable levels.

Figure 3.1. Thought experiment for US electricity to 2050. Numbers at bar tops are greenhouse gas emissions relative to 2005. The thought experiment is constructed as a variant of the Reference Scenario for 2040 of Annual Energy Outlook 2015.21 The 2005 and 2014 bars represent historical data. The 2030 bar represents the Reference Scenario projection adjusted to allow for early deployment of 22 capture plants storing CO2 via enhanced oil recovery during the technology cost buydown process.

The 2050 bar represents the thought experiment as described in the text. The following are additional assumptions for the thought experiment:

• Total generation and generation by each of nuclear, hydro, and geothermal supplies in 2050 are extrapolations of =2040 values from the Reference Scenario, assuming average Reference Scenario growth rates for 2035 to 2040.

• Biomass use for power generation in 2050 other than via CBTLE-CCS is zero.

• Oil use for power generation in 2050 is zero.

References

- Williams, R.H., 2016. Exploiting Near-Term BECCS to Facilitate a Low-Carbon Future for US Electricity. Manuscript in preparation, March, 2016.

- Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J. C. Minx (eds.). Technical Summary. In: Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- Biello, D., 2016. The Carbon Capture Fallacy. Sci. Am., 314(1): 59-65.

- Duke. R.D., 2002. Clean Energy Technology Buydowns: Economic Theory, Analytic Tools, and the Photovoltaic Case. Ph.D. Dissertation, Woodrow Wilson School of Public and International Affairs, Princeton University, Princeton, NJ.

- Unsubsidized photovoltaic module costs fell twelve-fold from 2000 to 2014. Falling costs have led to rapid deployment. In the US, photovoltaic generating capacity additions from 2011 to 2014 totaled 16.3 GWe, 1.4 times the capacity added for the natural gas combined cycle, the fossil fuel technology of choice for new US power in this period.

- Grubler, A., 2010. The costs of the French nuclear scale-up: a case of negative learning by doing. Energy Policy, 38(9): 5174-5188. doi:10.1016/j.enpol.2010.05.003.

- bp p.l.c., November 2015. bp Technology Outlook. London, UK.

- Phillips, B., 2010. Using Reverse Auctions in a Carbon Capture and Sequestration (CCS) Deployment Program. Boston: Clean Air Task Force.

- Plausibly the total cost of producing an additional barrel of US crude oil post-2025 with growing developing world oil demand.

- National Enhanced Oil Recovery Initiative, 2012. Carbon Dioxide Enhanced Oil Recovery: A Critical Domestic Energy, Economic, and Environmental Opportunity.

- CBTLE-CCS would also be characterized by ultra-low emissions of SO2, NOx, PM2.5, and Hg.

- Liu, G., E.D. Larson, R.H. Williams, T.G. Kreutz, and X. Guo, 2011. Making Fischer-Tropsch fuels and electricity from coal and biomass: performance and cost analysis. Energy and Fuels, 25(1): 415- 437. doi:10.1021/ef101184e.

- Consistent with the Administration’s goal of reducing overall greenhouse gas emissions for the US energy economy by 83% by 2050.

- 7.8 GWe/year and 2.0 GWe/year for CBTLE-CCS and NGCC-CCS, respectively.

- Power companies and their regulators often worry about electricity supply diversity loss that would arise if the power system were to become “overly dependent” on natural gas.

- For comparison, US net oil imports were 5.1 million barrels per day in 2014.

- US Department of Energy, 2011. US Billion-Ton Update: Biomass Supply for a Bioenergy and Bioproducts Industry. R.D. Perlack and B.J. Stokes (Leads), ORNL/TM-2011/224. Oak Ridge, TN: Oak Ridge National Laboratory.

- Zumkehr, A., and J.E. Campbell, 2013. Historical US cropland areas and the potential for bioenergy production on abandoned croplands. Environ. Sci. Technol., 47(8): 3840-3847. doi:10.1021/es3033132.

- Larson, E.D., G. Fiorese, G. Liu, R.H. Williams, T.G. Kreutz, and S. Consonni, 2010. Co-production of decarbonized synfuels and electricity from coal + biomass with CO2 capture and storage: an Illinois case study. Energy Environ. Sci., 3: 28-42. doi:10.1039/B911529C.

- Grubler, A., 2014. Grand designs: Historical patterns and future scenarios of energy technological change. In Energy Technology Innovation: Learning from Historical Successes and Failures. Eds. A. Grubler and C. Wilson. Cambridge, UK: Cambridge University Press, 39-53.

- US Energy Information Administration, 2015. Annual Energy Outlook 2015. Washington, DC: US Energy Information Administration.